Advisers are embracing change

- Rule changes are impacting on workloads, but are also a chance to demonstrate value.

- Advisers are confident of remaining profitable, but are increasing minimum portfolio size.

- Advisers agree that technology developments could enable them to see more clients.

Regulatory relief

Advisers and investors breathed a sigh of relief after the Budget, since many of the most feared changes did not materialise. A 72% majority of advisers told us that a reduction in tax-free cash was the policy that they would have been least supportive of. And the evidence suggests advisers largely guided their clients to sit on their hands. Unfortunately, speculation may have prompted some self-directed investors to take their tax-free cash prior to when they really needed to. As is the case with market volatility, the counsel to clients to ‘do nothing’ remains one of an adviser’s most important, yet undervalued, assets.

What is the policy you would be least supportive of:

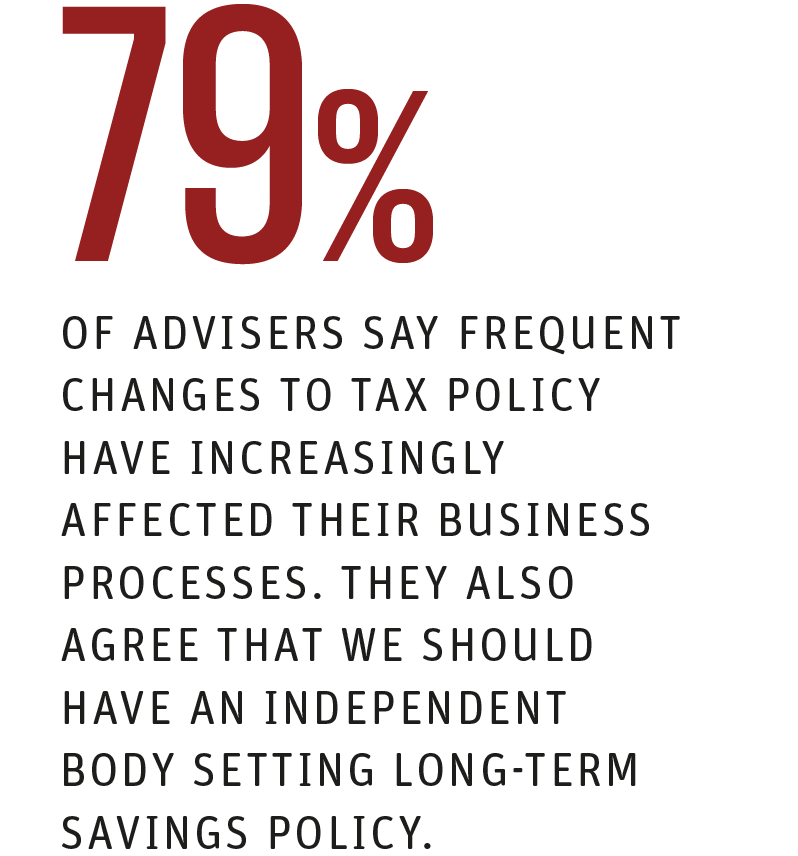

Advisers came into the recent Budget feeling a little jaded from the frequency of changes they have been having to deal with. The removal of the Lifetime Allowance (LTA) limit still looms large in the memory. 79% of advisers told us that their business processes have been increasingly affected by frequent changes to tax policy and allowances. As a result, 79% of advisers also agree that we should have an independent body setting long-term policy for retirement savings. Investors have a similar strength of feeling about independent policy setting for savings, with 84% of advised consumers and 81% of non-advised consumers in agreement.

Advisers: How much do you agree/disagree with the following:

The latest FCA rules that advisers must engage with are the new Sustainable Finance Disclosure Regulations (SDR), which aim to give investors more clarity on sustainable investments. Our survey reveals advisers are split on the usefulness of the new labels for guiding clients. 43% think they will be useful while 31% do not, a result which may reflect a broader split within the industry as some fund managers, including Vanguard, have opted out of using the new labels.

Change is a chance to demonstrate value

The Budget and the abolition of the LTA were both moments that allowed advisers to demonstrate the value of advice. Around half (48%) of advisers believe that regulatory and tax changes have positively affected their ability to add value for clients; 27% are neutral while 25% report a net negative impact. Change also has a downside of course: 81% of advisers report a negative impact from regulatory and tax changes on workloads, while 68% report a negative impact on the cost of doing business.

If the regulatory environment is creating heavier workloads and higher business costs, are advisers still confident of being able to charge enough to stay profitable? Encouragingly, the answer is yes with 77% of advisers confident that they will be able to charge enough in the future to stay profitable.

That said, our survey suggests advisers are refocusing on wealthier clients with more complex needs, where the fees earned can justify the higher costs of compliance. A 51% majority of advisers report that they have increased their minimum portfolio size over the last 12 months. The average minimum portfolio that surveyed advisers say they would take on is £117K, but this rises to £134K on average for advisers at firms with over £500m in assets.

What is the minimum portfolio size you take on?

Average minimum portfolio = 117K

Has your minimum portfolio size changed in the last 12 months?

Advisers are facing into the future of advice

The trillions of pounds regularly quoted in relation to the intergenerational wealth transfer can make it seem so large and unwieldy that individual advisers could be forgiven for putting it on the back burner while they deal with servicing clients. However, our survey suggests advisers are focused on the intergenerational opportunity, with a 63% majority (79% for the 18-35 cohort) disagreeing with the statement that ‘it is a problem for the next generation of advisers to solve’. Advisers, especially younger ones, see the great wealth transfer as a clear and present opportunity.

Another big ask of advisers is the need to address the advice gap by taking on more clients. Can technology be part of the solution? Advisers are hopeful. 61% believe that improvements in technology will enable them to look after more clients in five years’ time (16% disagree; 23% unsure). Again, this optimism is most pronounced among the youngest advisers, with 85% of the 18-35 cohort in agreement.

Will technology improvements enable you to look after more clients in 5 years?

What adviser to client ratios do you expect to be working with in 5 years?

We then asked advisers to forecast how many clients they expect to be looking after in five years. 56% of advisers believe they will be servicing between 90 and 200 clients. Given the current industry adviser-client ratio sits somewhere around the 1:90 level, these forecast increases are relatively modest. While advisers may be optimistic about technology progress, they are less keen to put stretch targets on how many more clients they might be able to see.

What is your firm’s current position on AI?

Artificial intelligence offers one potential route for driving process efficiencies and enabling advisers to manage more clients. Advice firms, especially the larger ones, are positive on AI, but there is still some cynicism among the smaller firms. 38% of adviser firms are currently using or testing AI tools, while 46% have not yet adopted AI but are interested in using it. Only 17% of adviser firms have not adopted AI and are not interested in it, and this proportion rises to 26% for the smallest firms with assets under £100m. Of those firms already using AI, a clear 74% majority are using it for the efficient recording and transcribing of meetings, with client report writing (29%) and data mining & analysis (18%) being the secondary use cases.

No matter how good the AI tools get, advisers and consumers are united about the enduring value of human contact at the heart of the advice process. A 76% majority of advisers believe that some of the value of advice could be lost in digital-only models (only 10% disagree, 14% neutral). Notably, this chimes with the finding that advised consumers most value face to face contact with their adviser over phone, email and video calling when: providing details on their financial situation; understanding their risk tolerance; undertaking an annual review; or discussing any significant changes to their financial plans.

Analysis

...it does make the relative attraction between drawdown and annuities more balanced...

The survey result on tax-free cash was no surprise as it’s an area of pensions that investors understand, so advisers will be relieved to see it unchanged. While the planned inclusion of pensions within the inheritance tax regime does little to diminish their usefulness for funding retirement, it does make the relative attraction between drawdown and annuities more balanced if both are now seen as a means of producing an income stream rather than a way in which to pass on wealth. We may see greater interest in blended approaches that combine elements of both approaches to provide a guaranteed income stream for essential living expenses alongside the invested growth engine of the drawdown pot.