Our aim is to be the best-connected platform, combining powerful tools and reporting with seamless integrations to the key systems you use every day.

Find our more below about what’s available to you after you log into the platform.

Our aim is to be the best-connected platform, combining powerful tools and reporting with seamless integrations to the key systems you use every day.

Find our more below about what’s available to you after you log into the platform.

The EVPro solutions, accessible through our platform, offer comprehensive suitability and capacity for loss tools. They enable you to explore drawdown and annuity options for clients approaching retirement.

Our EVPro solution comprises several modules designed to efficiently manage your clients’ finances.

These modules include:

Talk to your Business Development Manager regarding options for accessing this tool.

You’ll need to log into the Platform to access these tools. Any third-party tools are available to download from our Platform’s app store.

Our integration with FE fundinfo provides you with access to a Whole of Market fund range for analysis, Portfolio Scan functionality, a Fund Charting Tool, alongside all the latest Fund Literature hosted on HTML technology. Platform fund selections can be exported into FE fundinfo to negate the need for the rekeying of data.

The new Charting Tool also enables users to research up to 10 funds at anytime against a wide range of indices and sectors and report across varying time periods. The tool is hugely flexible and ensures that research parameters can be amended at any point without having to start the comparison work again.

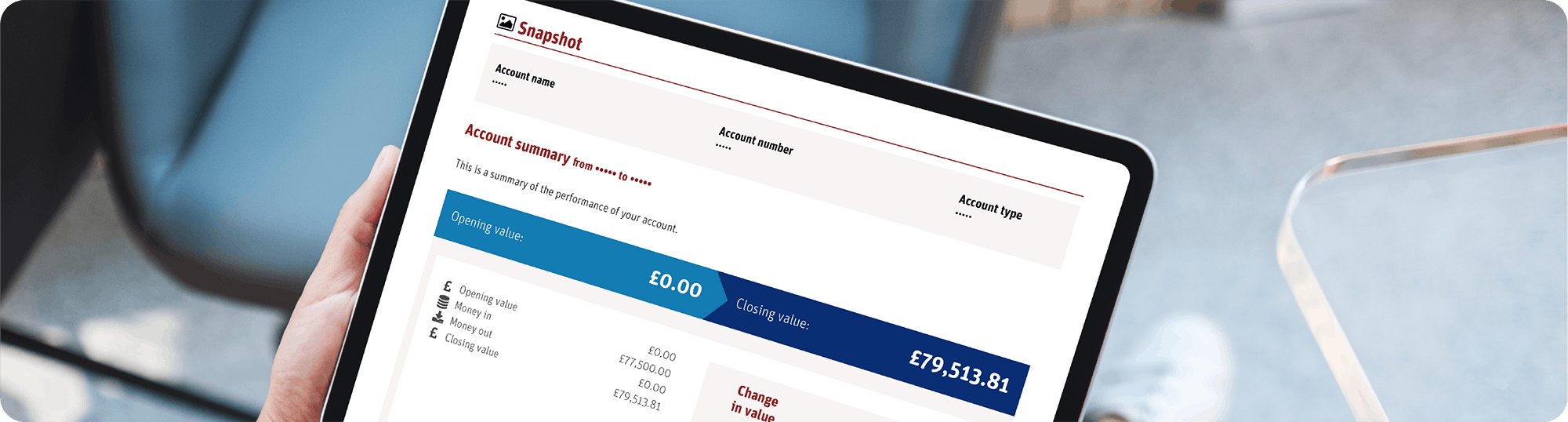

This brand new, integrated report enables you to construct a tailored report for your clients at either the account or product level.

Available sections include an introduction, account details, a snap-shot summary, valuations, performance, investment insights, and transaction details.

This integrated investment suitability software tool helps you match clients to tailored investment solutions. Comprising assessments that can be used to produce a suitability report, these look at financial circumstances and risk capacity, preferences for responsible investing and investment knowledge and experience.

Platform users can link their Investor Compass licence with their existing Platform credentials, allowing client’s details to be seamlessly pulled into the tool, reducing rekeying and data errors.

The integrated CGT tool enables you to calculate the realised capital gains and losses that your clients have incurred on the Scottish Widows Platform. It can also help you to scenario plan via ‘What If’ transactional capability as well as enabling you to correct Platform data where anomalies exist.

The Capital Gains Report will detail a summary position, at client-level, per taxable (GIA) Sub-Account. The report shows:

This integration gives you access to an application that helps you to produce simple yet comprehensive suitability reports to help streamline your advice process.

Users can link their ATEB licence with their Platform credentials, allowing a Platform client’s details to be seamlessly pulled into a suitability report, reducing re-keying time and potential errors.

This integrated wealth management tool helps you turn complex calculations into dynamic, visual client conversations. Building a plan that shows clients how they build wealth and manage income and modelling various scenarios and events.

Platform users can link to the application through their user interface, giving seamless access to their client data, which they can import directly into the tool.

An existing Voyant license and login is needed for access.

To access the tools you will need to be a registered user of the Scottish Widows Platform.

If you’re not yet part of Scottish Widows Platform, book a demo to explore our platform’s capabilities firsthand.